Live Ethereum Trading Analysis

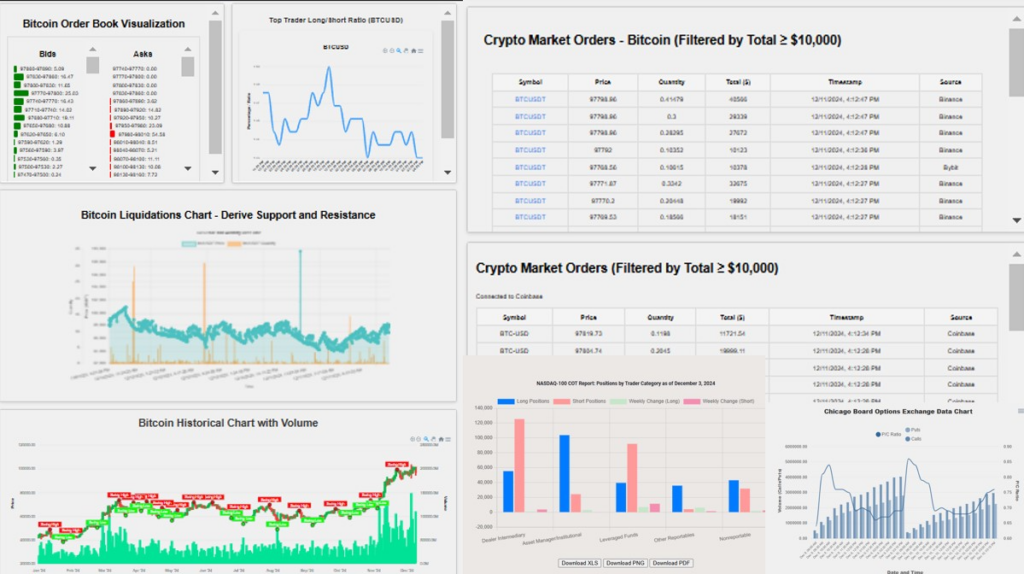

Stay ahead in the Ethereum market with live Ethereum market data that not only tracks key trends but also provides in-depth insights into order flow and Ethereum liquidations. Order flow refers to the movement of buy and sell orders within the market, giving you a glimpse into the overall market sentiment. By analyzing the flow, you can understand where the majority of traders are placing their orders—whether it’s leaning towards buying or selling—which can signal price shifts before they happen.

If you are interested in a detailed analysis, our partner company, Alternative Market Data provides Full Ethereum Trading Book Analysis.

The top trader ratio is another key indicator to monitor, showing the behavior of the wealthiest or most experienced traders. When the ratio is higher, it suggests that these top traders are placing more long positions, signaling confidence in upward price movements. Tracking this ratio alongside Ethereum data helps you gauge where market professionals are positioning themselves.

By studying the order book, you can identify crucial support and resistance levels where large buy and sell orders are clustered. These levels provide critical insights into potential price points that could hold or break, giving traders an edge in predicting future market movements.

Leverage this rich, real-time Ethereum data and Ethereum liquidations to make smarter decisions, stay ahead of market trends, and navigate the ever-changing crypto landscape with confidence.