Pepe Live Order Flow

Analyzing Large Orders and Order Flow in Pepe: A Strategic Approach

Pepe, a cryptocurrency that has gained significant traction in the market, is not just another token. Its volatility and the excitement surrounding its community make it a prime candidate for traders who are keen on tracking and analyzing the movements of large orders and order flow. But what exactly does it mean to analyze large orders in Pepe, and how can you use this data to enhance your trading strategy? Let’s dive in.

Understanding Order Flow in Pepe

Order flow refers to the sequence and volume of orders (buy and sell) that occur on the market. By monitoring the order flow, traders can gain insights into the market’s overall sentiment, predicting price movements before they happen. Here’s how to analyze it in the context of Pepe:

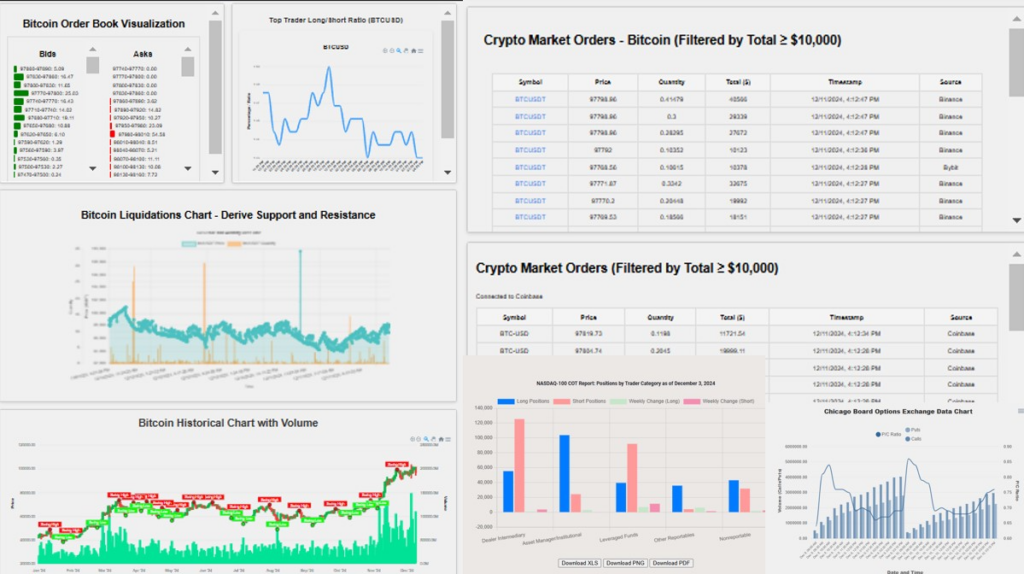

- Bid vs. Ask Orders: Start by looking at the bid and ask orders for Pepe. The bid orders indicate the price at which buyers are willing to purchase Pepe, while the ask orders reflect the price sellers are offering. By comparing the depth and frequency of both, traders can gauge whether buyers or sellers dominate the market. A stronger bid side might suggest buying pressure, while a strong ask side may indicate selling pressure.

- Liquidity: Pepe’s liquidity can provide insights into its price stability. A highly liquid market allows for smoother order execution without significant price slippage, whereas low liquidity may lead to erratic price movements. Monitoring the liquidity on exchanges helps you understand how easily large orders can be absorbed without moving the market drastically.

- Market Makers and Takers: Identifying the presence of market makers (who provide liquidity by placing orders) and market takers (who execute orders against the existing liquidity) is crucial. A market dominated by takers could indicate that traders are aggressively entering or exiting positions, while a healthy mix suggests balanced participation.

Tracking Large Orders in Pepe

Large orders, or “whale trades,” can have a profound impact on the market. Monitoring these orders in real-time allows traders to make informed decisions and even anticipate potential market shifts.

- Identify Whale Trades: Whale trades are typically orders that exceed a specific size, often significantly larger than the average trade volume. On a decentralized exchange (DEX) like Uniswap or a centralized exchange (CEX), traders can use analytics platforms or dashboards to track large transactions in real-time. If a large buy order is placed on Pepe, it may indicate an upcoming price surge, while a large sell order might suggest downward pressure.

- Price Impact: Large orders, especially on low-volume markets like Pepe, can cause significant price movements. Analyzing the price impact of these trades will help you determine if the order is truly a market-moving event or simply a routine trade. A sudden drop in price after a large sell order could indicate a bear trend, while a spike in price after a big buy order may signal bullish sentiment.

- Monitor Order Book Changes: Large orders often don’t happen in isolation. They typically come with changes to the order book, where new orders are placed or existing orders are modified to reflect the large trade. By monitoring the changes in the order book, traders can spot where the next big move might occur. For example, a large order placed near the current market price could signal an impending breakout.