Real-Time Bitcoin Trade Data

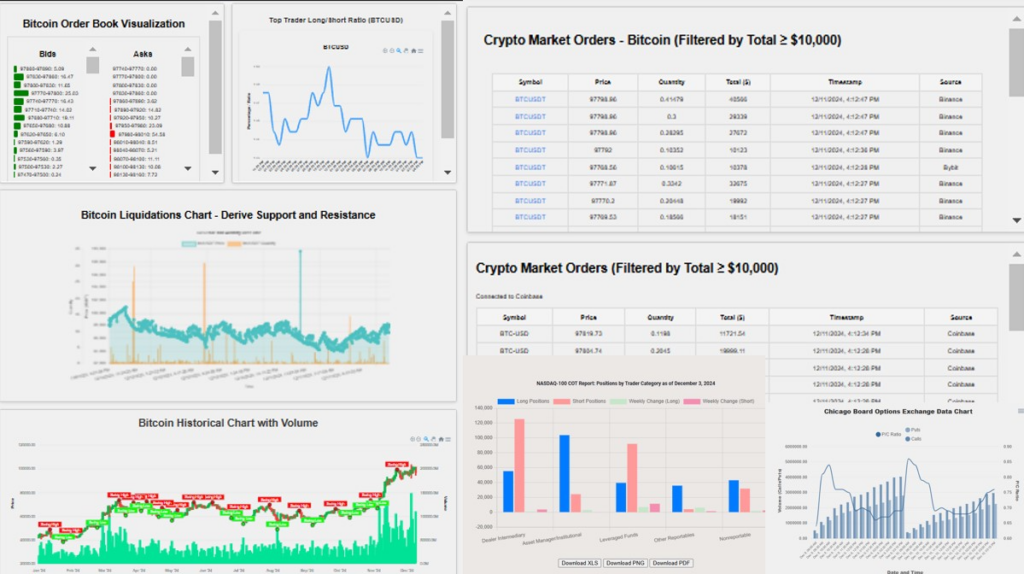

Real-time Bitcoin data is essential for tracking bitcoin movements, understanding bitcoin data trends, and making informed decisions. It’s no surprise that the top 20% of traders on platforms like Binance are among the richest, showcasing the power of real-time Bitcoin trade data in driving successful strategies. By understanding the order book flow, traders can detect market sentiment—green (buying activity) dominating red (selling activity) often signals bullish momentum.

If you are interested in more comprehensive analysis, our partner company, Alternative Market Data provides Full Bitcoin Trading Book Analysis.

Bitcoin Ratio and Market Sentiment: A Key Indicator for the Richest Traders on Binance

In the world of Bitcoin trading, the Bitcoin ratio serves as a crucial indicator of market sentiment. When the ratio is higher than 1, it suggests that there are more long positions than short positions, reflecting a bullish outlook. This ratio is especially significant when analyzing the trading behavior of the top 20% richest traders on Binance, who often leverage such insights to maximize their profits. By monitoring this Bitcoin data, traders can gauge the overall market sentiment, with a higher ratio indicating confidence in upward price movement. This real-time crypto data helps you understand market trends and make smarter trading decisions, just like the wealthiest traders on Binance.

Coinbase, on the other hand, sees many of its orders originating from the USA, indicating a strong domestic interest in crypto trading. With this Coinbase Bitcoin data and other crypto data, you can capitalize on these regional trends and leverage key market insights. By analyzing real-time Bitcoin data, traders can spot opportunities, track bitcoin price fluctuations, and understand buying and selling pressure, all while adapting to the fast-paced nature of the cryptocurrency market. Stay informed, and turn data into profits.

Bitcoin Data and Order Clusters: Identifying Support and Resistance Levels

In addition to tracking Bitcoin ratio and trade data, tools like order clusters can provide crucial insights for investors looking to pinpoint key support and resistance levels. By analyzing Bitcoin data through order clustering, traders can see where large buy and sell orders are concentrated. These clusters often indicate areas of strong support (where buyers are ready to step in) and resistance (where selling pressure is likely to push prices down). Understanding these order clusters allows investors to make more informed decisions, anticipate price movements, and navigate the ever-changing crypto market with confidence. Leverage this Bitcoin data to enhance your trading strategy and stay ahead in the competitive world of cryptocurrency.