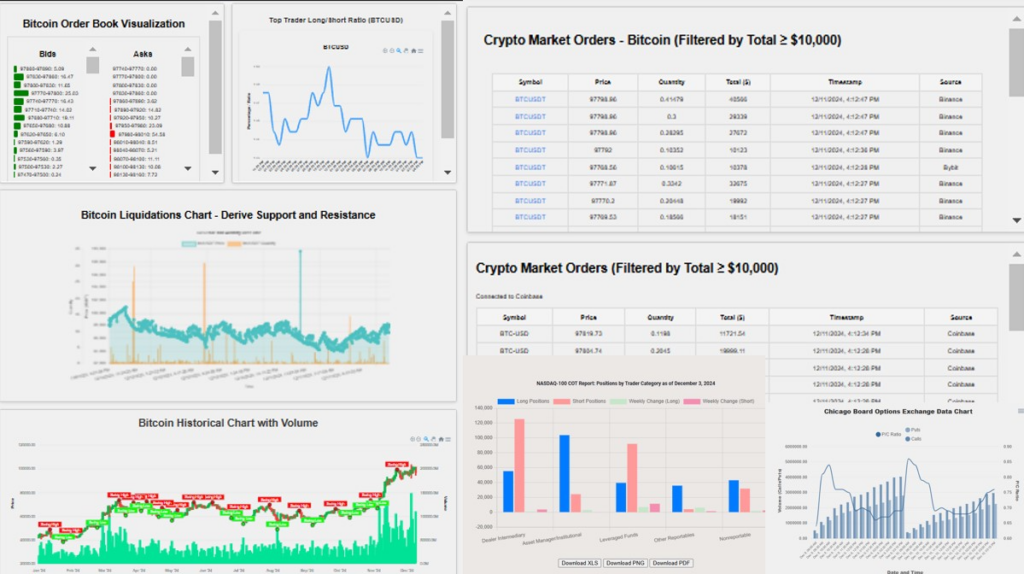

Source: Chicago Board Options Exchange

We analyze the Chicago Board Options Market daily, providing valuable insights not only for U.S. markets but also for the crypto market! By monitoring the put-to-call ratio, we can detect potential signals—if the ratio exceeds 1, it triggers an alarm indicating a possible crypto market correction!

Daily Analysis of the Chicago Board Options Market and Its Impact on U.S. and Crypto Markets

The Chicago Board Options Market (CBOE) plays a crucial role in understanding market sentiment, not just for traditional U.S. markets but also for the cryptocurrency space. By examining the daily fluctuations of the put-to-call ratio, we can gain valuable insights into market psychology and predict potential movements in both equity and crypto markets.

Understanding the Put-to-Call Ratio

The put-to-call ratio is a key indicator used to measure the balance of bearish versus bullish sentiment in the market. A ratio above 1 means that there are more put options being bought than call options, indicating that traders expect the market to decline. This ratio is often viewed as a bearish signal, as it suggests increased demand for downside protection.

The Impact on the U.S. Market

In traditional U.S. markets, a put-to-call ratio above 1 is often interpreted as a warning of potential market corrections or heightened volatility. Traders watch this closely to assess the likelihood of a downturn in major indices such as the S&P 500 or the Nasdaq.

Crypto Market Insights from the Put-to-Call Ratio

Interestingly, the put-to-call ratio from U.S. options markets can also provide valuable signals for the crypto market. Cryptocurrencies, known for their volatility, often mirror traditional market trends, and a spike in the put-to-call ratio can act as an early warning system for a potential correction in the crypto market. When the ratio exceeds 1, it suggests increased pessimism, which could foreshadow a decline in major cryptocurrencies like Bitcoin and Ethereum.

Why Daily Analysis Matters

By analyzing the CBOE’s put-to-call ratio daily, we can identify shifts in sentiment early, helping traders make informed decisions in both the U.S. and crypto markets. For crypto traders, this means the ability to anticipate downturns, adjust strategies, and potentially hedge against risk.

Conclusion

The daily monitoring of the Chicago Board Options Market, particularly the put-to-call ratio, provides a powerful tool for forecasting market movements. This analysis extends beyond traditional equity markets, offering valuable predictive insights into the crypto market, where volatility can be even more pronounced. By paying attention to signals like a ratio above 1, traders can stay ahead of potential market corrections and protect their investments.

Disclaimer: The information above is not financial advice. It is intended for informational purposes only and should not be construed as a recommendation.