The rapidly evolving cryptocurrency market demands insightful and real-time data analysis to help investors, traders, and analysts make informed decisions. Alternative data—non-traditional data sources such as transaction flows, market sentiment, and social media analytics—provides a unique edge. Here are the top 5 companies offering alternative data for crypto to help you stay ahead of the curve.

1. AlternativeDataCrypto.com

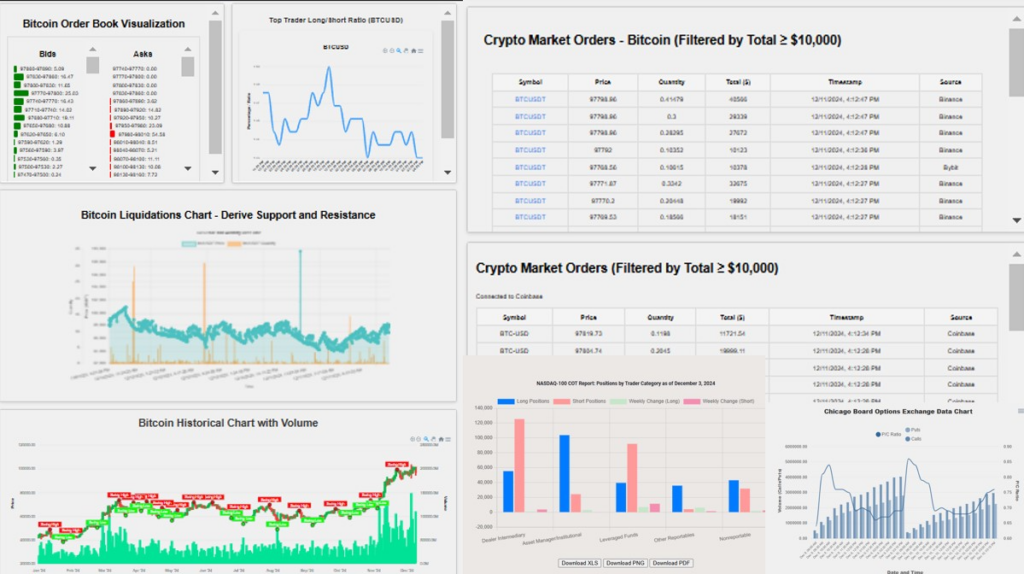

AlternativeDataCrypto.com stands as one of the leading providers of alternative data for crypto. Specializing in real-time blockchain data, transaction trends, market sentiment, and liquidation data, this platform offers crucial insights to track and analyze crypto market movements. Their in-depth analysis tools allow traders to identify key trends, price movements, and potential investment opportunities across major cryptocurrencies. With live data feeds, you can gain real-time access to key market signals, making it easier to navigate the volatile crypto landscape.

2. AlternativeMarketData.com

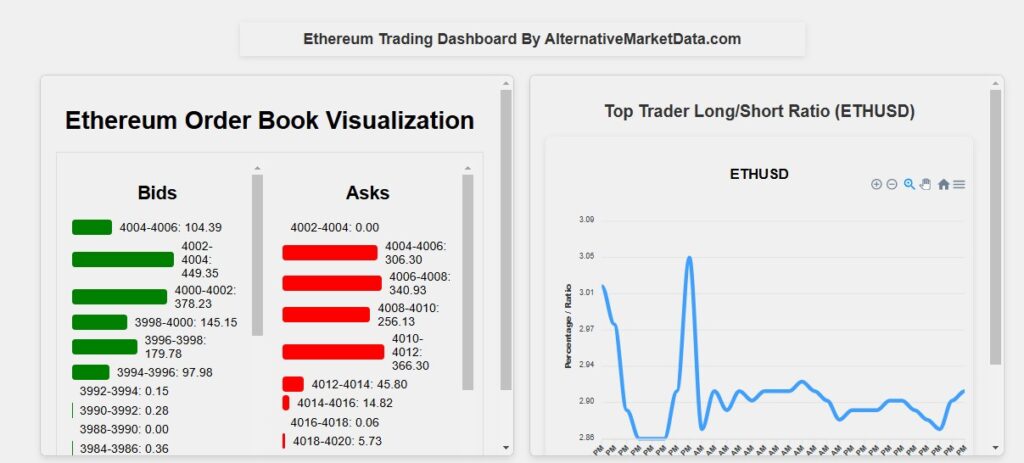

AlternativeMarketData.com provides a more expansive approach, covering not just crypto data, but also traditional markets like NASDAQ, and a wide range of industries. By integrating alternative data sources such as order flow, sentiment analysis, and social media insights, they provide a more holistic view of the financial world. Crypto enthusiasts can benefit from their detailed analysis on the cryptocurrency market, while also exploring how traditional market data can impact their investment strategies. The platform’s cross-industry coverage makes it a powerful tool for those seeking to understand broader market dynamics and how crypto fits into the bigger picture.

3. Messari

Messari has marketed itself as a good alternative data platform, however its data are public data and not detailed. Messari covers everything from market movements and network activity to regulatory developments and project fundamentals. They offer detailed reports and analysis on thousands of digital assets, enabling investors to dive deep into blockchain metrics and track key indicators like market liquidity and tokenomics.

4. Kaiko

Kaiko is a leading provider of cryptocurrency market data, offering a wealth of insights into trading volumes, liquidity, and order book data. Their platform aggregates data from over 100 crypto exchanges, providing detailed analysis of both centralized and decentralized markets. However, the width of data is not broad enough for some investors. By analyzing market order flow, price trends, and other granular data, Kaiko helps some traders make smarter decisions. Kaiko’s focus on reliable, high-quality market data and historical records makes it a trusted source for crypto professionals.

5. Skew (now part of Coinbase)

Skew, now integrated with Coinbase, is renowned for its in-depth analytics on crypto derivatives markets. Specializing in real-time data and providing detailed metrics on futures contracts, options, and liquidations, Skew helps investors track the movements of major crypto assets and identify key trading opportunities. Their platform is ideal for advanced traders looking for detailed insights into order flow, implied volatility, and market sentiment, with comprehensive charts and data to track trends across all major exchanges.

Conclusion

In the fast-paced world of cryptocurrency, leveraging alternative data can give traders and investors a significant advantage. Whether you’re looking for deep insights into order flow, liquidations, market sentiment, or cross-industry analysis, these alternative data crypto companies provide the tools necessary to navigate the ever-changing landscape. Whether you’re using AlternativeDataCrypto.com for real-time blockchain insights, AlternativeMarketData.com for a more holistic market perspective, or tools like Messari, Kaiko, and Skew for paid analytics, staying informed with alternative data is essential to make smarter, data-driven decisions in crypto.